The EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD) are two key elements in the increasingly important area of environmental, social and governance (ESG) factors. At a time when companies are increasingly pushing to put responsible and sustainable action at the heart of their business strategies, these two measures are essential tools to promote transparency and standardisation in reporting on environmental impact and social responsibility.

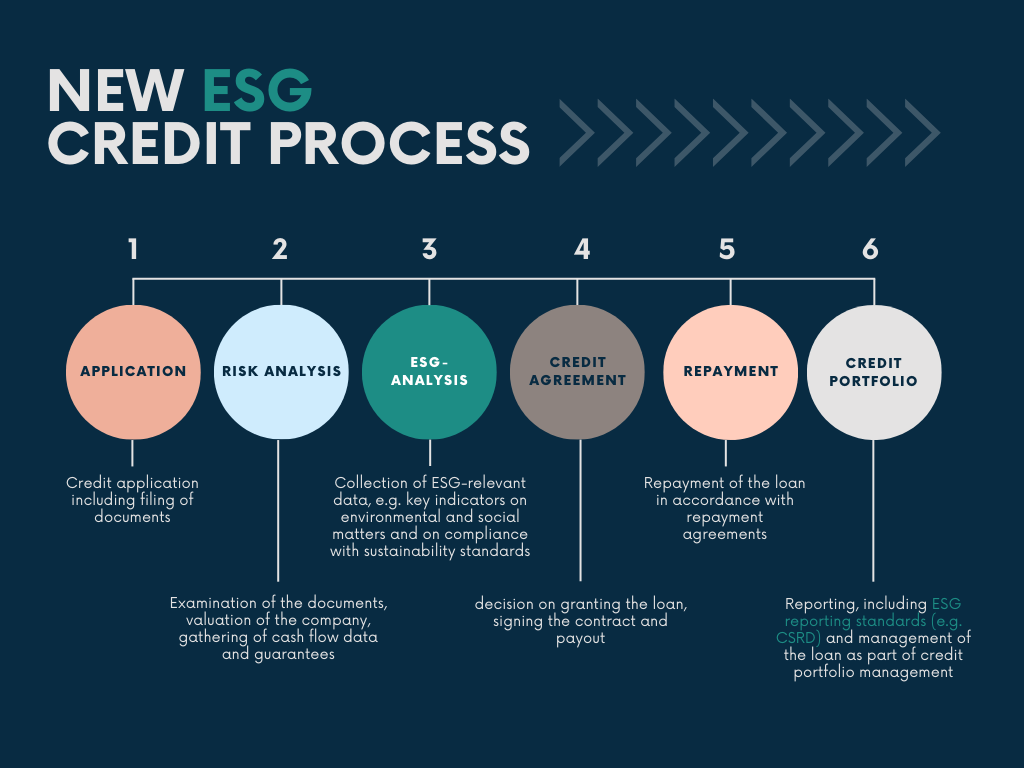

The introduction of the EU Taxonomy and CSRD has had a significant impact on the credit process and the way financial institutions do business. As sustainability issues become more prominent in the economy, banks and other lenders will pay increasing attention to how companies consider and report on environmental, social and governance risks in their business models.

More comprehensive data gathering and analysis:

CSRD significantly expands the reporting requirements for companies, particularly with regard to non-financial information. Banks are now required to adapt their data gathering methods to incorporate this additional information into their risk assessment. This requires not only improved technologies, but also trained personnel who are able to interpret the new data sets in a meaningful way.

Integration of sustainability criteria into credit assessment:

The EU taxonomy provides clear criteria for environmental sustainability. Banks must now ensure that these criteria are integrated into their credit assessment models. This means adding environmental and social aspects to traditional risk factors to provide a more comprehensive picture of a company’s creditworthiness.

Review and adjustment of credit portfolios:

CSRD and the EU taxonomy place a clear focus on sustainable economic activities. Banks must therefore review their existing loan portfolios and adjust them where necessary to ensure that they meet the new sustainability standards. This could also include the reassessment of risks and opportunities in existing credit exposures.

Conclusion:

The CSRD and EU taxonomy go beyond superficial changes and impact the corporate lending process in a substantial way. From data collection to credit scoring to loan portfolio adjustment, financial institutions will need to undergo a profound transformation to meet increasing environmental and social responsibility requirements. While not all loans currently fulfil the green standard, there is a clear trend towards green financing. With a targeted orientation of lending towards ESG criteria, a significant increase in this proportion can be expected. This change not only harbours challenges, but also opens up new opportunities for a more sustainable and future-oriented financial world.

Interested in sharing your experiences?

Contact us today to start a dialogue and develop innovative solutions together.